Category: Latest News

National Insurance threshold rises

The £6 billion tax cut will see the level at which people start paying National Insurance rise to £12,570 – lifting 2.2 million people out of paying any personal tax and ensuring people get to keep more of the money they earn.

The threshold change means that 70% of UK workers will pay less National Insurance, even after accounting for the Health and Social Care Levy that is funding the biggest catch-up programme in NHS history and putting an end to spiralling social care costs.

The last major personal tax cut of today’s magnitude was nearly ten years ago, when the income tax personal allowance increased by £1,100 in 2013. Today’s threshold change is more than double that, as working people are now able to hold on to an extra £2,690 free from tax.

Read MoreThe National Minimum Wage in 2022

New rates of the National Living Wage (NLW) and National Minimum Wage (NMW) come into force on 1 April 2021. These follow recommendations made in the autumn by the Low Pay Commision (LPC). To mark the uprating, this report looks ahead at the implications of the incoming rates and the LPC’s remit for the year ahead.

The new NLW and NMW rates are set out below. The NLW applies to all workers aged 23 and over. This will come down again to 21 by 2024.

| Rate from April 2022 | Current rate (April 2021 to March 2022) | Increase | |

|---|---|---|---|

| National Living Wage | £9.50 | £8.91 | 6.6% |

| 21-22 year old rate | £9.18 | £8.36 | 9.8% |

| 18-20 year old rate | £6.83 | £6.56 | 4.1% |

| 16-17 year old rate | £4.81 | £4.62 | 4.1% |

| Apprentice rate | £4.81 | £4.30 | 11.9% |

| Accommodation offset | £8.70 | £8.36 | 4.1% |

These increases mark the first step on the path to the Government’s target of an NLW set at two-thirds of median earnings by 2024. This report sets out the latest pathway to that target, based on projections of average pay growth. We are currently consulting on the NLW and NMW rates to be introduced from April 2023.

Link: The National Minimum Wage in 2022

Read MoreAdvisory fuel rates from 1st March 2022 to 31st May 2022

The advisory electricity rate for fully electric cars is 5 pence per mile.

Hybrid cars are treated as either petrol or diesel cars for advisory fuel rates.

The advisory fuel rates for petrol, LPG and diesel cars are shown in these tables.

Petrol

- 1400cc or less – 13p/mile

- 1401cc to 2000cc – 15p/mile

- Over 2000cc – 22p/mile

LPG

- 1400cc or less – 8p/mile

- 1401cc to 2000cc – 10p/mile

- Over 2000cc – 15p/mile

Diesel

- 1600cc or less – 11p/mile

- 1601cc to 2000cc – 13p/mile

- Over 2000cc – 16p/mile

Further information: Advisory fuel rates

Read MoreThe National Minimum Wage in 2022

New rates of the National Living Wage (NLW) and National Minimum Wage (NMW) come into force on 1 April 2022. These follow recommendations made in the autumn by the Low Pay Commision (LPC). To mark the uprating, this report looks ahead at the implications of the incoming rates and the LPC’s remit for the year ahead.

The new NLW and NMW rates are set out below. The NLW now applies to all workers aged 23 and over. The previous age of eligibility was 25. This will come down again to 21 by 2024.

- National Living Wage – (Previous Rate) £8.91 – (Rate from April 2022) £9.50 – (Increase) 6.6%

- 21-22 Year Old Rate – (Previous Rate) £8.36 – (Rate from April 2022) £9.18 – (Increase) 9.8%

- 18-20 Year Old Rate – (Previous Rate) £6.56 – (Rate from April 2022) £6.83 – (Increase) 4.1%

- 16-17 Year Old Rate – (Previous Rate) £4.62 – (Rate from April 2022) £4.81 – (Increase) 4.1%

- Apprentice Rate – (Previous Rate) £4.30 – (Rate from April 2021) £4.81 – (Increase) 11.9%

- Accommodation Offset – (Previous Rate) £8.36 – (Rate from April 2022) £8.70 – (Increase) 2.0%

These increases mark the first step on the path to the Government’s target of an NLW set at two-thirds of median earnings by 2024. This report sets out the latest pathway to that target, based on projections of average pay growth. We are currently consulting on the NLW and NMW rates to be introduced from April 2023.

Link: The National Minimum Wage in 2022

Read MoreThe National Insurance Rise 2022

From 6th April 2022 to 5th April 2023 National Insurance contributions will increase by 1.25%. For example, this will take Class 1 National Insurance from 12% to 13.25%. The rise will be used to be spent on the NHS, health and social care in the UK.

The increase will apply to:

- Class 1 (paid by employees)

- Class 4 (paid by self-employed)

- Secondary Class 1, 1A and 1B (paid by employers)

The increase will not apply if you are over the State Pension age.

Class 1 National Insurance thresholds

You can only make National Insurance deductions on earnings above the lower earnings limit.

| Class 1 National Insurance thresholds | 2022 to 2023 |

|---|---|

| Lower earnings limit | £123 per week £533 per month £6,396 per year |

| Primary threshold | £190 per week £823 per month £9,880 per year |

| Secondary threshold | £175 per week £758 per month £9,100 per year |

| Freeport upper secondary threshold | £481 per week £2,083 per month £25,000 per year |

| Upper secondary threshold (under 21) | £967 per week £4,189 per month £50,270 per year |

| Apprentice upper secondary threshold (apprentice under 25) | £967 per week £4,189 per month £50,270 per year |

| Veterans upper secondary threshold | £967 per week £4,189 per month £50,270 per year |

| Upper earnings limit | £967 per week £4,189 per month £50,270 per year |

Class 1 National Insurance rates

Employee (primary) contribution rates

Deduct primary contributions (employee’s National Insurance) from your employees’ pay through PAYE.

| National Insurance category letter | Earnings at or above lower earnings limit up to and including primary threshold | Earnings above the primary threshold up to and including upper earnings limit | Balance of earnings above upper earnings limit |

|---|---|---|---|

| A | 0% | 13.25% | 3.25% |

| B | 0% | 7.1% | 3.25% |

| C | nil | nil | nil |

| F (Freeport) | 0% | 13.25% | 3.25% |

| H (apprentice under 25) | 0% | 13.25% | 3.25% |

| I (Freeport – married women and widows reduced rate) | 0% | 7.1% | 3.25% |

| J | 0% | 3.25% | 3.25% |

| L (Freeport – deferment) | 0% | 3.25% | 3.25% |

| M (under 21) | 0% | 13.25% | 3.25% |

| S (Freeport – state pensioner) | nil | nil | nil |

| V (veteran) | 0% | 13.25% | 3.25% |

| Z (under 21 – deferment) | 0% | 3.25% | 3.25% |

Employer (secondary) contribution rates

You pay secondary contributions (employer’s National Insurance) to HMRC as part of your PAYE bill.

Pay employers’ PAYE tax and National Insurance.

| National Insurance category letter | Earnings at or above lower earnings limit up to and including secondary threshold | Earnings above secondary threshold up to and including Freeport upper secondary threshold | Earnings above Freeport upper secondary threshold up to and including upper earnings limit, upper secondary thresholds for under 21s, apprentices and veterans | Balance of earnings above upper earnings limit, upper secondary thresholds for under 21s, apprentices and veterans |

|---|---|---|---|---|

| A | 0% | 15.05% | 15.05% | 15.05% |

| B | 0% | 15.05% | 15.05% | 15.05% |

| C | 0% | 15.05% | 15.05% | 15.05% |

| F (Freeport) | 0% | 0% | 15.05% | 15.05% |

| H (apprentice under 25) | 0% | 0% | 0% | 15.05% |

| I (Freeport – married women and widows reduced rate) | 0% | 0% | 15.05% | 15.05% |

| J | 0% | 15.05% | 15.05% | 15.05% |

| L (Freeport – deferment) | 0% | 0% | 15.05% | 15.05% |

| M (under 21) | 0% | 0% | 0% | 15.05% |

| S (Freeport – state pensioner) | 0% | 0% | 15.05% | 15.05% |

| V (veteran) | 0% | 0% | 0% | 15.05% |

| Z (under 21 – deferment) | 0% | 0% | 0% |

Link: The National Insurance in 2022

Link: Rates & Thresholds 2022-2023

Read MoreAdvisory fuel rates from 1st December 2021 to 28th February 2022

The advisory electricity rate for fully electric cars is 5 pence per mile.

Hybrid cars are treated as either petrol or diesel cars for advisory fuel rates.

The advisory fuel rates for petrol, LPG and diesel cars are shown in these tables.

Petrol

- 1400cc or less – 13p/mile

- 1401cc to 2000cc – 15p/mile

- Over 2000cc – 22p/mile

LPG

- 1400cc or less – 9p/mile

- 1401cc to 2000cc – 10p/mile

- Over 2000cc – 15p/mile

Diesel

- 1600cc or less – 11p/mile

- 1601cc to 2000cc – 13p/mile

- Over 2000cc – 16p/mile

Further information: Advisory fuel rates

Read MoreAdvisory fuel rates from 1st September 2021 to 30th November 2021

The advisory electricity rate for fully electric cars is 5 pence per mile.

Hybrid cars are treated as either petrol or diesel cars for advisory fuel rates.

The advisory fuel rates for petrol, LPG and diesel cars are shown in these tables.

Petrol

- 1400cc or less – 12p/mile

- 1401cc to 2000cc – 14p/mile

- Over 2000cc – 20p/mile

LPG

- 1400cc or less – 7p/mile

- 1401cc to 2000cc – 8p/mile

- Over 2000cc – 12p/mile

Diesel

- 1600cc or less – 10p/mile

- 1601cc to 2000cc – 12p/mile

- Over 2000cc – 15p/mile

Further information: Advisory fuel rates

Read MoreChanges to the coronavirus job retention scheme

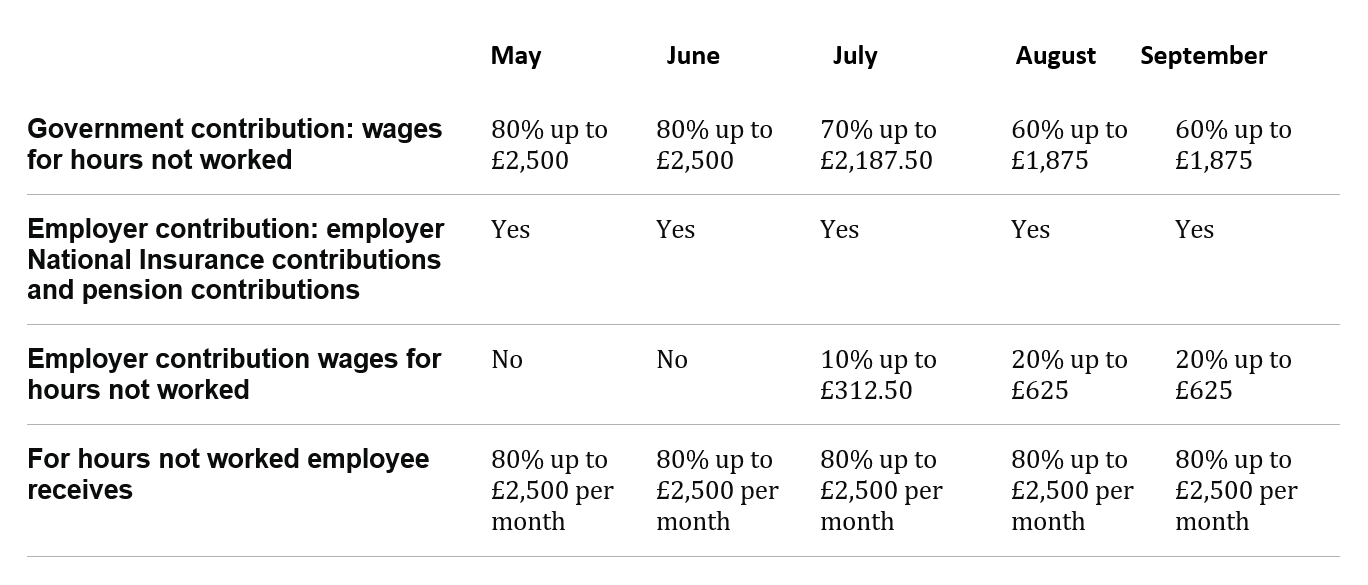

The Coronavirus job retention scheme (Furlough) has been extended until the 30th September 2021.

The level of grant the government contributes towards this will change from the 1st of July 2021. From 1 July 2021, the government will pay 70% of wages up to a maximum cap of £2,187.50 for the hours the employee is on furlough. To be eligible for furlough employers must continue to pay furloughed workers 80% of their wages, up to £2,500 per month.

The below table shows the level of contribution available until September 2021.

Employers can continue to choose to top up their employees’ wages above the 80% total and £2,500 cap for the hours not worked at their own expense.

Link: Changes to government retention scheme

Read MoreAdvisory fuel rates from 1st June 2021 to 31st August 2021

The advisory electricity rate for fully electric cars is 4 pence per mile.

Hybrid cars are treated as either petrol or diesel cars for advisory fuel rates.

The advisory fuel rates for petrol, LPG and diesel cars are shown in these tables.

Petrol

- 1400cc or less – 11p/mile

- 1401cc to 2000cc – 13p/mile

- Over 2000cc – 19p/mile

LPG

- 1400cc or less – 8p/mile

- 1401cc to 2000cc – 9p/mile

- Over 2000cc – 14p/mile

Diesel

- 1600cc or less – 9p/mile

- 1601cc to 2000cc – 11p/mile

- Over 2000cc – 13p/mile

Further information: Advisory fuel rates

Read More95% mortgage scheme launches

A new government backed mortgage scheme launched on 19th April 2021. The Scheme will help first time buyers or current homeowners secure a mortgage with just a 5% deposit to buy a house of up to £600,000. This provides an affordable route to home ownership for aspiring homeowners.

The scheme is now available from lenders on high streets across the country, with Lloyds, Santander, Barclays, HSBC and NatWest launching mortgages under the scheme today and Virgin Money following next month.

The government is committed to supporting people who aspire to become homeowners, helping over 685,000 households to purchase a home since 2010 through government backed schemes including Help to Buy and Right to Buy.

Other government home ownership options available include

95% Mortgages: From today (19 April) first time buyers will be able to purchase a home with only a 5% deposit. The scheme will help to increase the supply of 5% deposit mortgages for credit-worthy households by supporting lenders to offer these products through a government-backed guarantee.

Help to Buy: A government equity loan that supports first time buyers with a low interest loan towards their deposit.

Shared Ownership: Gives first time buyers the option to buy a share of their home (between 25% and 75%) and pay rent on the remaining share.

First Homes: A new scheme designed to help local first-time buyers and keyworkers onto the property ladder, by offering homes at a discount of 30% compared to the market price.

The Scheme has been introduced as a temporary measure and will be open for new mortgage applications between April 2021 & December 2022. The Government will review towards the planned end date whether there will be an extension on the 5% deposit after reviewing if this would continue to deliver benefits for prospective homeowners.

Link: 95% Mortgage scheme

Read More